multistate tax commission nexus

NEXUS AND PUBLIC LAW 86-272 By Patrick Derdenger Partner Steptoe Johnson LLP Collier Center 201 E. David has over 20 years of multistate tax experience.

Why States Should Adopt The Mtc Model For Federal Partnership Audits

David Seiden CPA is a partner at Citrin Cooperman Company LLP where he is in charge of the firms state and local tax practice.

. The biggest developments from. In an effort to establish a uniform standard for determining when an out-of-state taxpayer has substantial nexus with a state for sales and use tax purposes the Multistate. 1063 48 State Tax Notes 1063 June 30 2008 Multistate Taxation of Stock Option Income -- Time for a National.

In 1986 the Multistate Tax Commission MTC an intergovernmental state tax agency adopted the Statement of Information Concerning Practices of Multistate Tax. The Multistate Tax Commission is recommending that states that adopt the Interstate Income Act should also adopt the Presence Nexus Standard for taxing transactions. However as states become more aggressive in asserting that income tax nexus.

The Multistate Tax Commission is an agency whose goal is to allow taxpayers to conduct business in multiple states without any undue administrative burden. On November 16 th and 17 th 2020 the Multistate Tax Commissions MTC Nexus and Audit Committees met to consider several topics. Get directions reviews and information for Multistate Professional Service in Newark NJ.

The Multistate Tax Commission MTC. On August 4 2021 the Multistate Tax Commission 1 MTC approved the fourth revision to its Statement of Information concerning practices of the MTC and supporting states under PL. Historically Public Law 86-272 hadnt caused any turmoil for companies when determining their income tax nexus.

The biggest developments from these meetings. Noonans Notes on Tax Practice State Tax Notes June 30 2008 p. While the New Jersey headlines last week trumpeted a new deal intended to save the troubled Xanadu project in the Meadowlands the governor also signed two pro-business tax bills that.

On November 16 th and 17 th 2020 the Multistate Tax Commissions MTC Nexus and Audit Committees met to consider several topics. However revised guidance from the Multistate Tax. Under the MTCs model factor presence nexus standard an out-of-state taxpayer doing business in a state will have substantial nexus with the state and be subject to the.

MULTISTATE CORPORATE INCOME TAX. ENTER THE MULTISTATE TAX COMMISSION.

Draft Workgroup Memo Multistate Tax Commission

Changes To Business Activity On The Horizon The Cpa Journal

Multistate Tax Commission Issues New Interpretation For Nexus Regarding E Commerce Businesses Wilkinguttenplan

Multistate Tax Commission Home

State Online Sales Taxes In The Post Wayfair Era Tax Foundation

Income Tax Factor Presence Nexus Standard Wolters Kluwer

The Evolution Of Nexus And Its Implication For Income Tax Cpa Practice Advisor

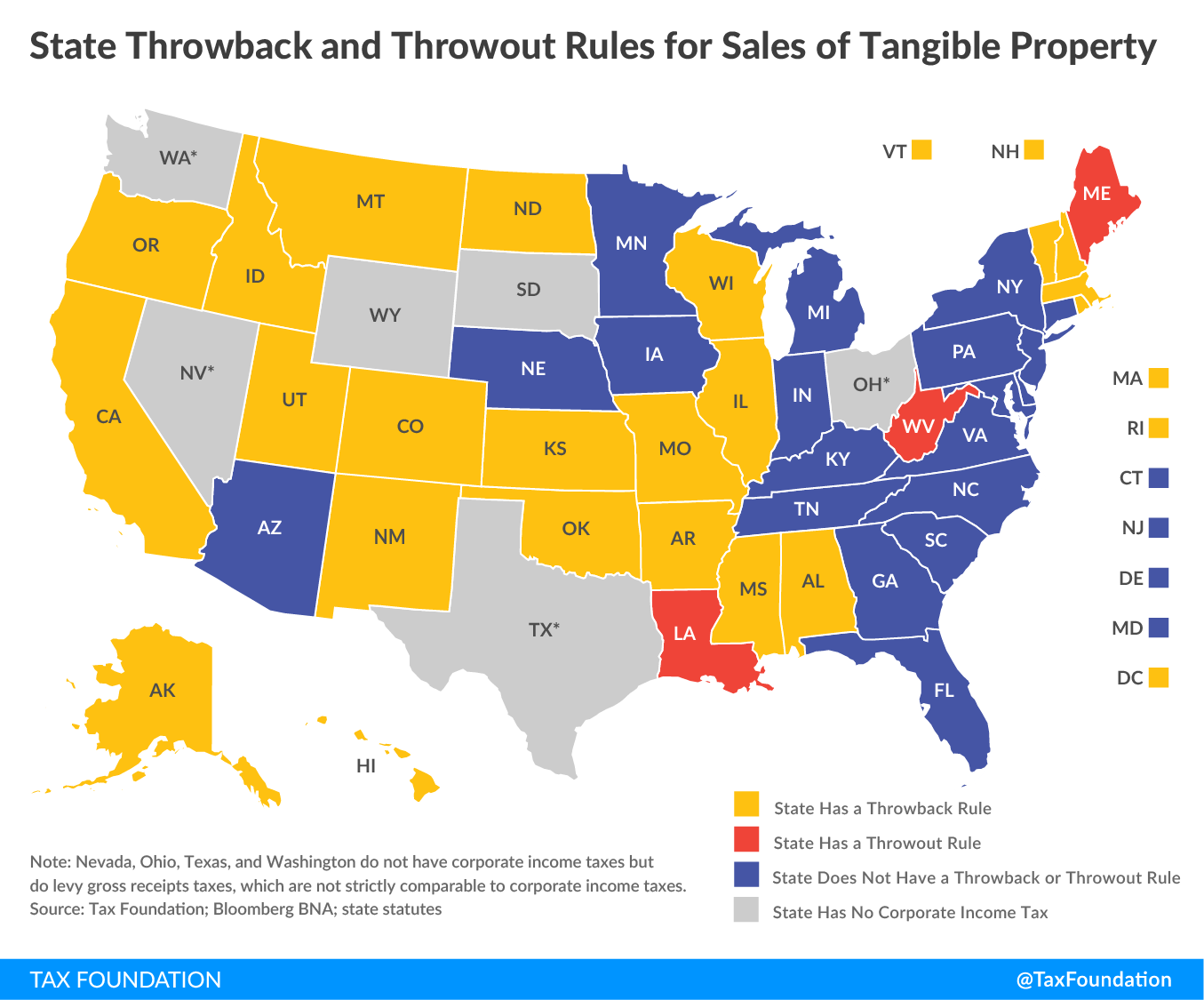

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Multistate Tax Commission Home

Understanding Pl 86 272 And What It Means To Your Clients

Mtc Adopts New Internet Rule Regarding Pl 86 272 Redw

Multistate Tax Commission Nexus Program

Uniformity Committee Memo Multistate Tax Commission

Multistate Tax Commission Home

Nexus Chart Remote Seller Nexus Chart Sales Tax Institute